How Plain Numbers transforms understanding of the cost of credit.

The challenge: people struggle to understand the cost of credit.

When borrowing money, people rely on financial information to assess costs and choose the best loan for their needs.

At Plain Numbers, we help organisations communicate financial information more effectively. To test the impact of our unique method, we partnered with ClearScore and Thinks Insights to explore whether clearer, more intuitive credit information could improve consumer comprehension. In particular, we were interested in whether including APR and a representative example helps decision-making.

The research: testing how to present credit costs more effectively.

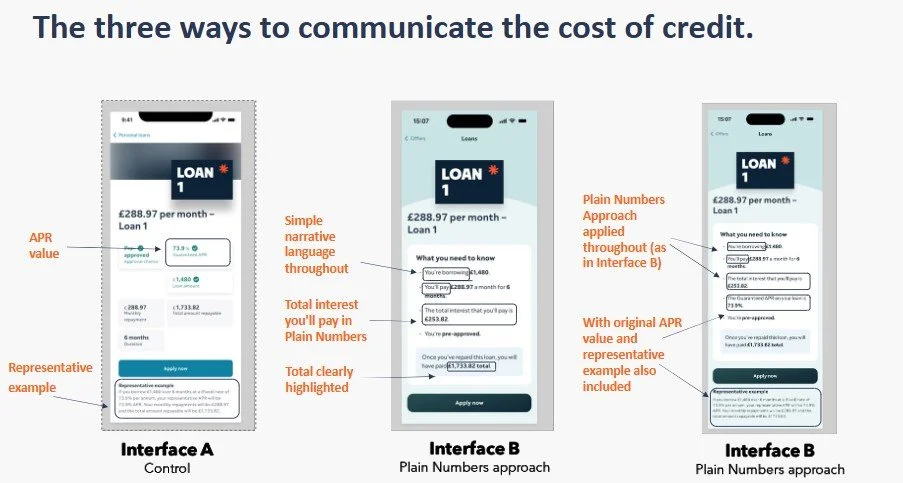

Thinks Insights ran a randomised controlled trial with over 2,000 participants, testing three different ways of presenting the cost of credit:

1️⃣ Control Version (current standard) – The original ClearScore interface, featuring APR and a representative example.

2️⃣ Plain Numbers Approach (without APR and representative example) – A version that simplified language and content by removing APR and the representative example.

3️⃣ Plain Numbers Approach (within current regulations) – A redesigned version applying the Plain Numbers method while keeping APR and the representative example.

The results: Plain Numbers significantly improves understanding.

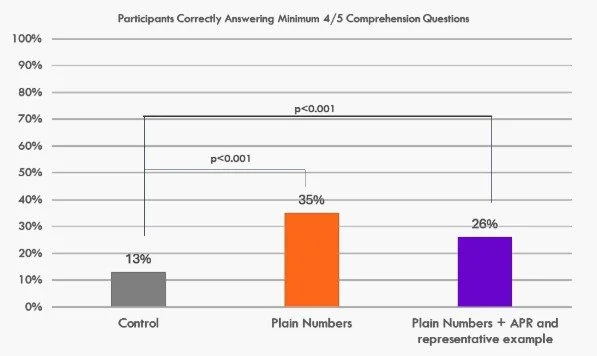

The findings were striking:

Plain Numbers doubled comprehension within existing regulations – when APR and the representative example were included.

Plain Numbers almost tripled comprehension when APR and the representative example were removed.

Perceived clarity was high across all versions, but actual comprehension lagged far behind. This highlights a major gap—people think they understand, but in reality, they don’t.

Download our deeper dive into the trial and results here:

What this means: less is more

The results confirm — simplification leads to better understanding.

The Plain Numbers Approach works within existing regulations to double comprehension.

Removing APR and representative examples altogether can almost triple comprehension, showing that less is often more when it comes to effective communication.

Next steps: transforming financial communication.

By applying the Plain Numbers Approach, financial organisations can:

✅ Present information in a way that truly helps customers.

✅ Improve engagement and trust.

✅ Ensure compliance while making real improvements to understanding.

At Plain Numbers, we’re proving that clearer communication leads to better outcomes.

There is plenty that all firms can do to rethink how they present financial information within current regulatory constraints —because when people understand, everyone benefits. These results also suggest there are exciting opportunities to change regulations to further improve customer understanding.

Want to learn more? Let’s talk about how we can help you to improve customer understanding. Contact us.